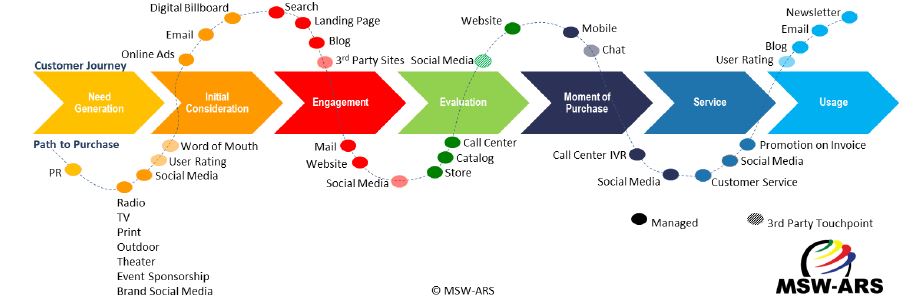

Brands are built over time as a function of commercial and non-commercial communication and consumer experience at each moment of truth. Technology has relentlessly increased the ways in which consumers come in contact with brands, both opening new opportunities for brands to make a positive impact on consumer perceptions but also creating a challenge for brands to design a coherent and integrated strategy for managing a wide array of communication and experiential initiatives which will appropriately impact target consumers who are at different stages of their relationship with the brand and category.

The customer journey has emerged as a useful conceptualization of an integrated approach to marketing communications at an enterprise level.

From a research standpoint, the opportunity exists to apply common metrics that measure short-term and long-term communications success across functions, within functions, and within elements of each function, across the customer journey. MSW-ARS solutions for each step of the journey contain the Customer Commitment Preference® (CCP) metric. The patented CCP metric is the only independently validated measure of brand value and is at the core of The Brand Strength Monitor (TBSM), the syndicated MSW-ARS brand strength tracking solution.

Starting in early 2018, MSW-ARS augmented the TBSM survey to include assessment of the status of a respondent’s category journey and also the perceived importance of different sources of product information along the path to purchase.

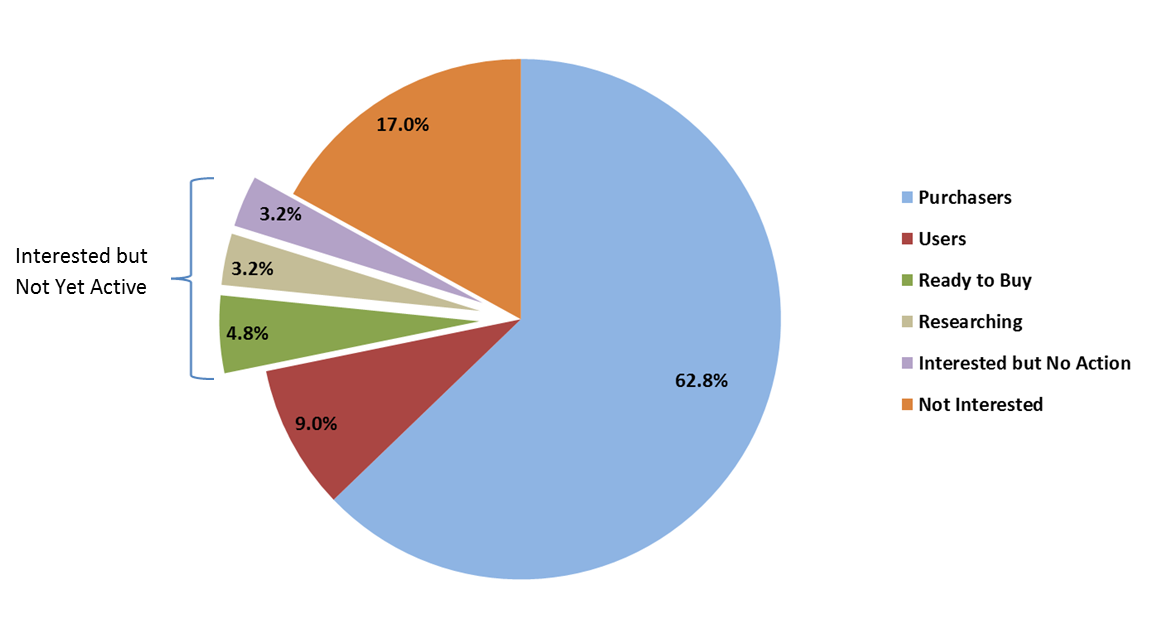

Specifically, for each product category a respondent is classified in one of the following ways in terms of current interest in the category:

- Purchasers

- Users (not purchasers)

- Intended purchasers/users (ready to buy or use in near future)

- Actively researching category (but not ready to buy)

- Interested in category (but taken no action)

- Not interested in product category

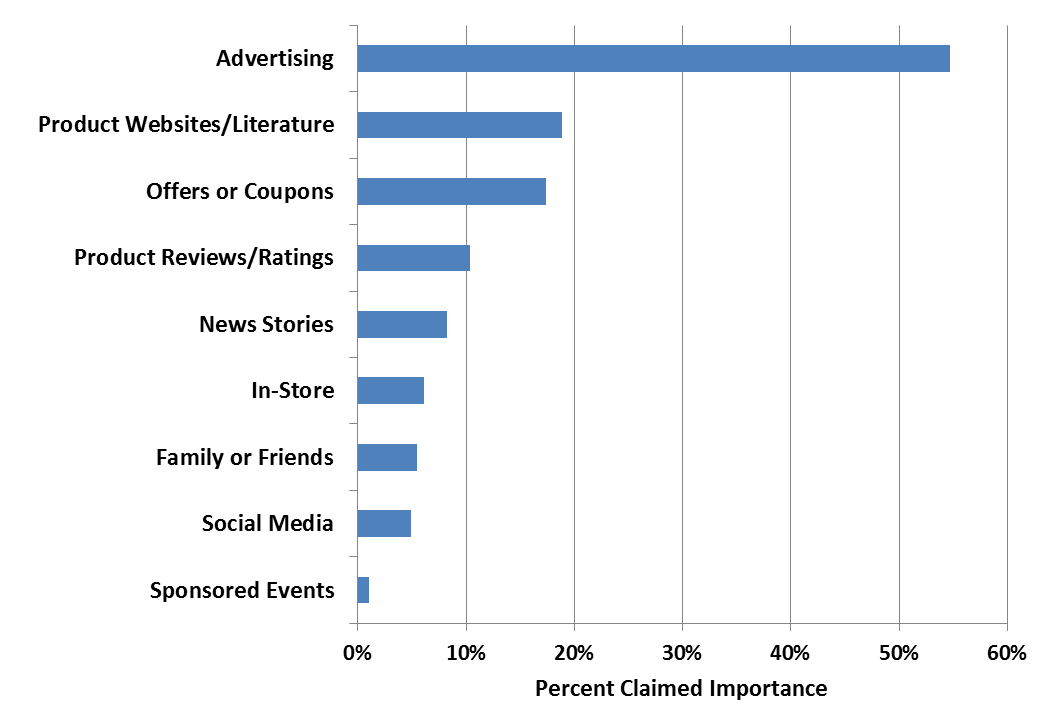

Those respondents who are interested in the category but not yet active are asked which sources of information about products in the category are important to them right now, while category purchasers are asked to indicate why they chose the brand they did on their last purchase occasion. In combination with demographics, brand preferences and the category journey classifications, this information can inform a brand’s actions in terms of reaching their target consumers in the most appropriate ways on their path to purchase.

This is the first in a series of blogs which will look at specific aspects of these customer journey metrics as collected in the TBSM survey.

In this installment we will take a quick look at the importance of different sources of information among those respondents who are interested but not yet active in a given category, aggregated across the different product categories that are currently being tracked with TBSM. Across more than fifty-thousand observations, over 60-perecent of respondents are current category purchasers. While only 11.2% of respondents are interested but not yet active, this still represents nearly 6000 responses.

Despite complaints about and efforts to avoid advertising by consumers, well over half of those category interested but not yet active respondents cited some type of advertising as being an important source of information in that particular product category. Next most cited were product websites or literature and special offers or coupons.

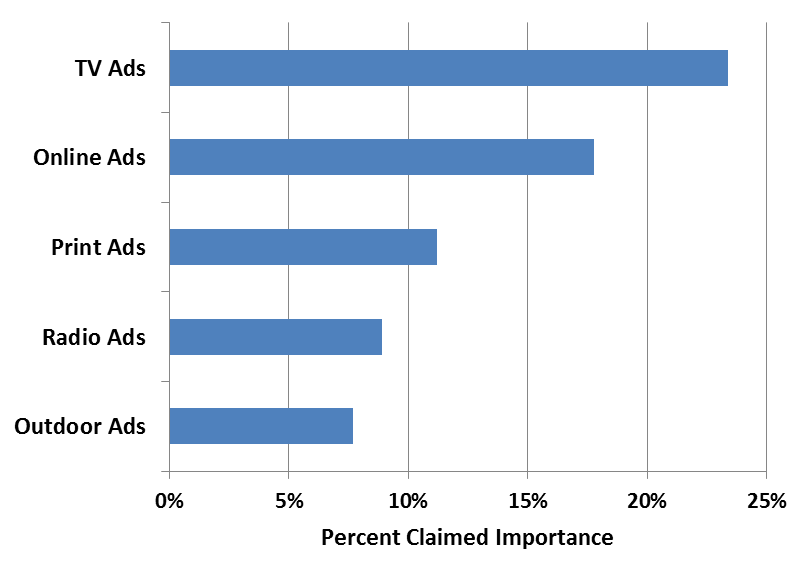

And in fact among the different types of advertising, it is the much maligned and prematurely eulogized television ad that was most frequently cited as being an important source of product information.

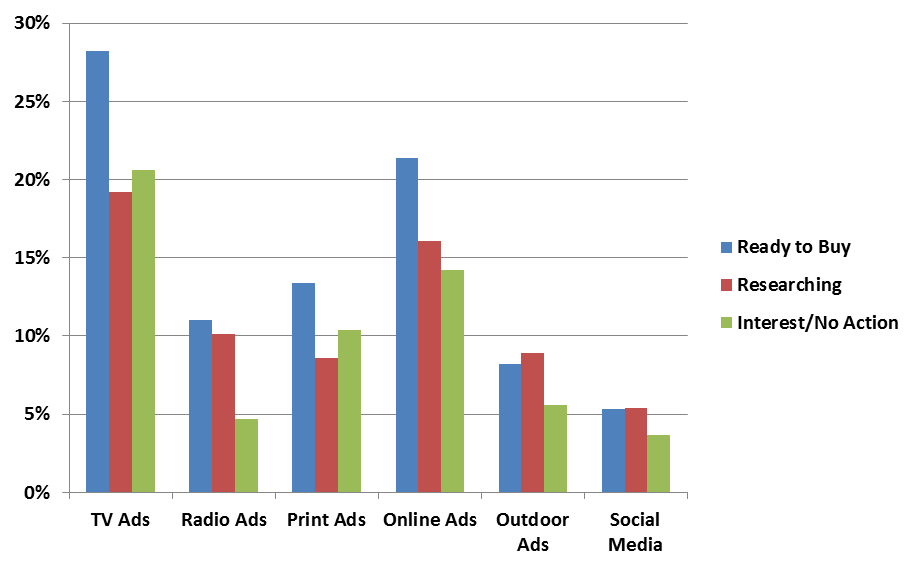

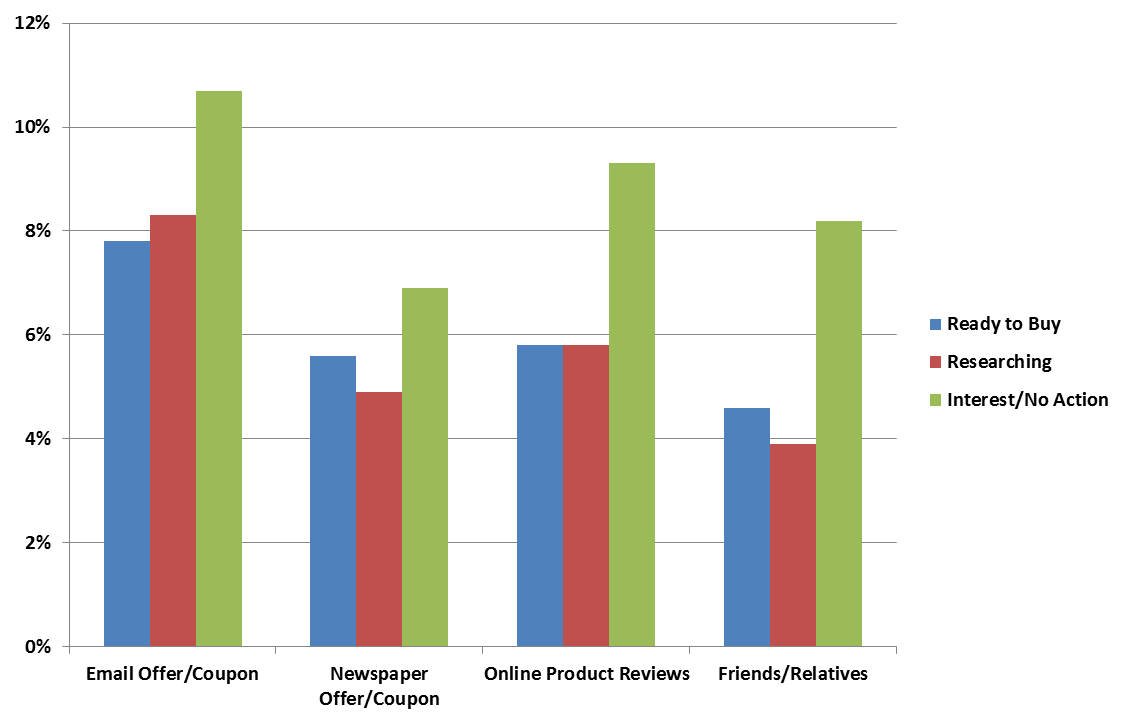

When this data is broken down for respondents who are ready to buy versus actively researching versus interested but have taken no action, we find some differences in the relative interest levels for certain of the information sources. Specifically, those who are ready to buy are relatively more likely to find advertising – particularly TV, online and radio – and social media to be important sources of information right now.

On the other hand, those who are interested in the product category but have as yet taken no action are more likely to find special offers/coupons, online product reviews and word of mouth to be important sources of information in the category right now. This suggests that online reviews and friends/relatives are commonly consulted early in the consumer’s journey to purchase in the category for the first time; and also that there are consumers who are completely price driven and wait for a good deal without doing prior active research gathering in the product category.

Of course, these results are averages across a wide variety of diverse categories and the reality in your particular category may vary. The Brand Strength Monitor can help you understand the dynamics of your particular category or target group. Please contact us at sales@thebrandstrengthmonitor.com for more information.