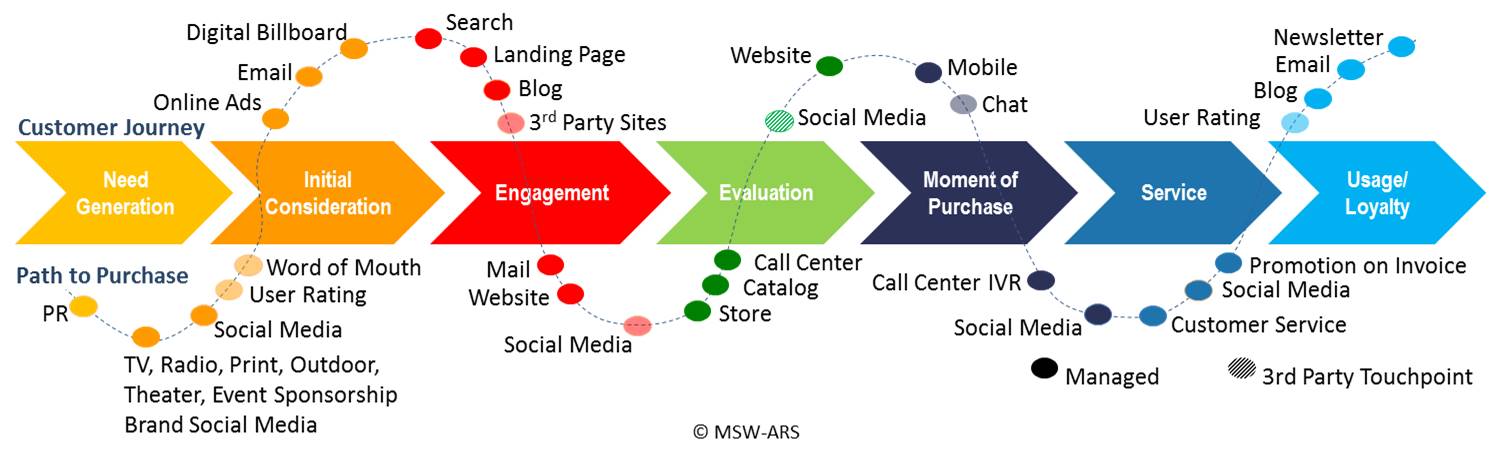

There are many different channels of information that a brand’s potential customers may be exposed to during the course of their journey toward making a purchase from that brand. Taken together, these channels – which will influence the customer positively or negatively – form the path to purchase.

While all brands should attend to the various information channels along the path to purchase so that each can be effectively activated by target customers, there are certain channels that customers are more likely to depend on for particular product categories.

As part of The Brand Strength Monitor (TBSM), the syndicated MSW-ARS brand strength tracking solution: we collect information on the perceived importance of some of the most prominent information channels along the path to purchase. Using nearly 8000 recent responses from TBSM tracking in the U.S., we have identified six category-based trends in customer information seeking behavior.

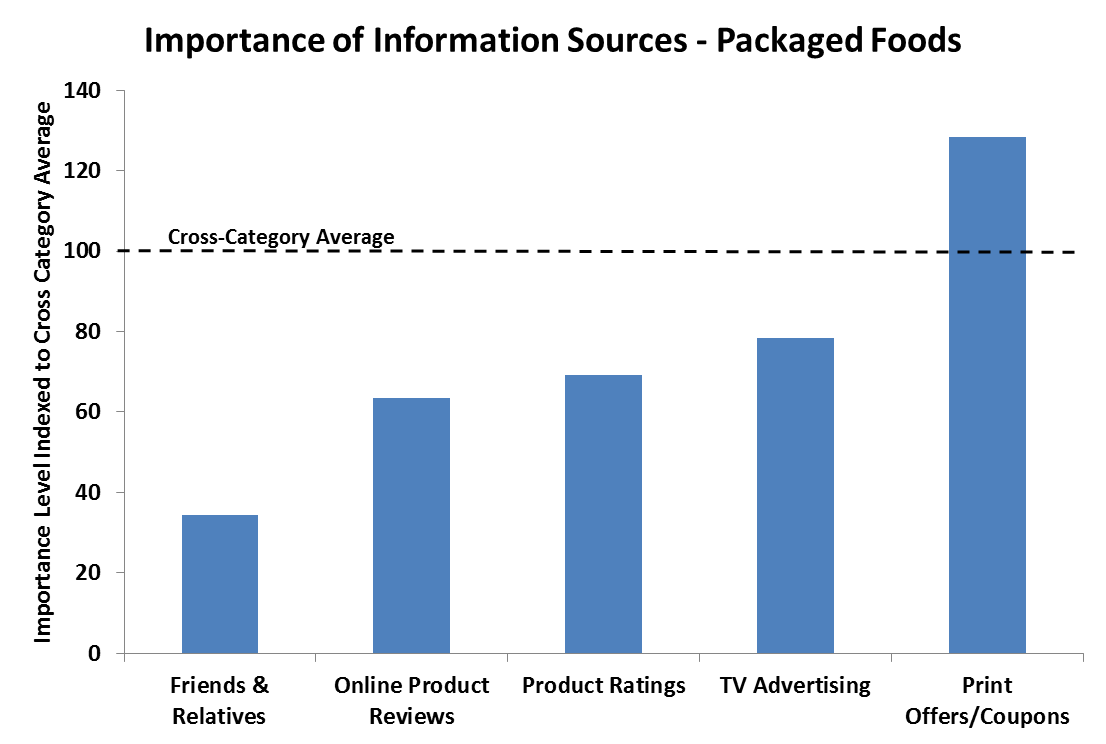

Packaged Foods = Low Involvement

While Americans may love their snack foods – and have the waistlines to prove it – they apparently aren’t too interested in researching their purchases of packaged food items. Across six packaged food categories tracked by TBSM, most information sources are rated as relatively unimportant (versus other product categories). Particularly low are word-of-mouth, on-line product reviews, product ratings and even television advertising. The one big exception is special offers/coupons: particularly those in print (think the still popular supermarket circulars, for example).

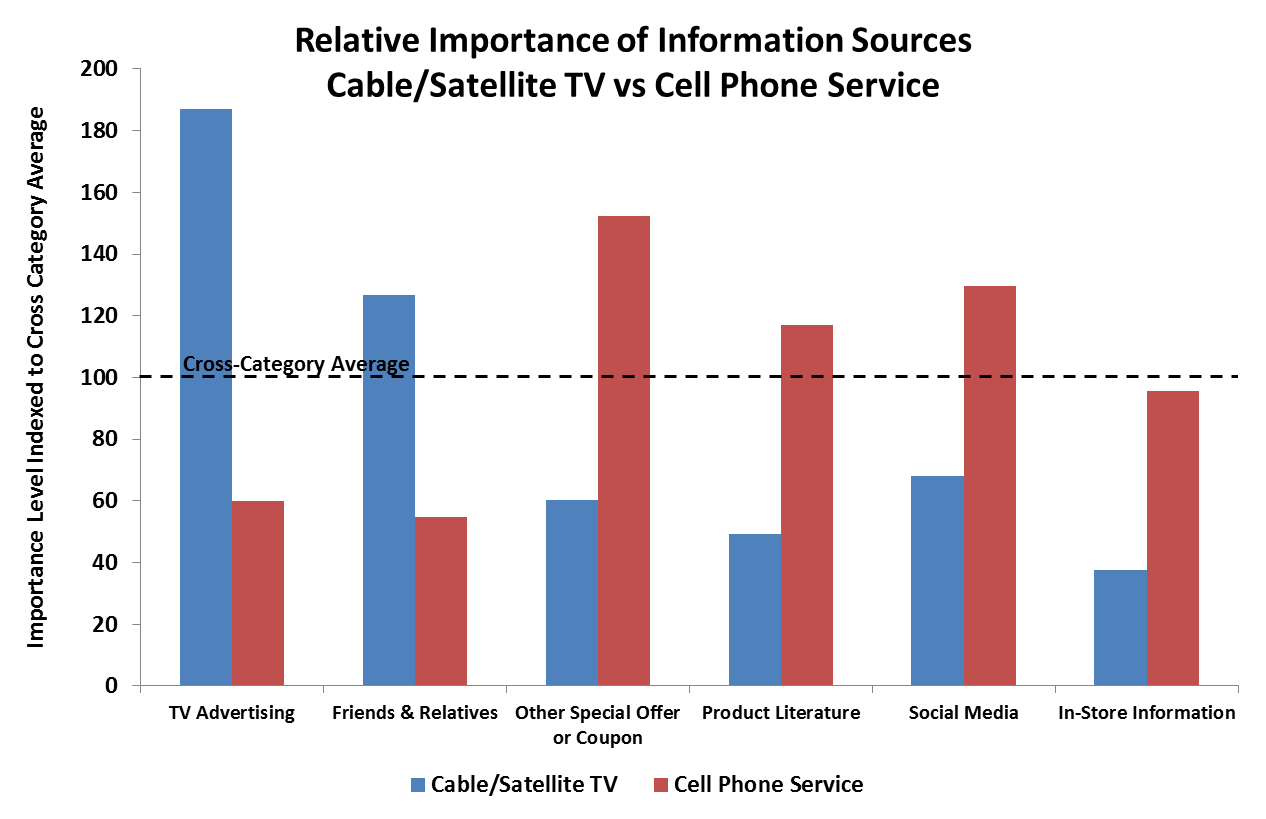

Very Similar Categories, Different Approaches

The cell phone service and cable/satellite TV categories would appear to be very similar – with some of the same major players in each. Yet the importance ratings of different sources of product information in these two categories stand in stark contrast to each other. While one might suspect demographic differences between prospective customers in these two categories might be behind this phenomenon, particularly given the graying of television, in fact there are not large differences in the demographic profiles for these two categories.

Specifically, prospects in the cable/satellite TV category are much more likely to rely on advertising. This is especially true for television advertising which has over three times the importance level for cable/satellite TV customers in comparison to those in the cell phone service category. Cable/satellite TV customers are also more likely to seek product information from friends and relatives, while cell phone service customers are much more likely to rely on special offers, product literature, social media and in-store information.

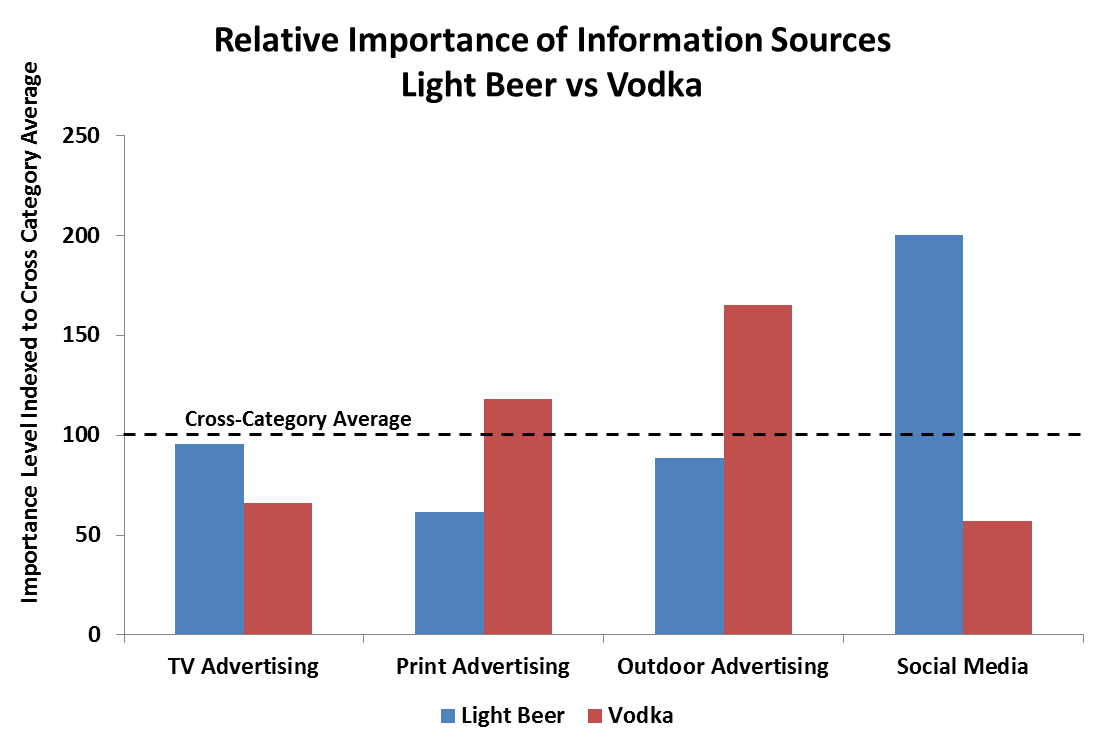

Alcohol Advertising – Liquor Still Feeling Effects of Advertising Ban?

For most of the second half of the 20th century, liquor companies operated under a self-imposed ban on television advertising. While that changed shortly before the turn of the century, information source importance ratings for vodka versus light beer suggest there is still a residual effect from this ban. Specifically, importance for television advertising for light beer is roughly at parity with the cross-category average while its importance is much lower than average for vodka.

However, importance is much higher in the vodka category for more traditional types of liquor advertising, namely print and outdoor (in fact vodka has the highest importance level for outdoor advertising among all categories tracked within TBSM). One other interesting tidbit is that social media is deemed relatively quite important in the light beer category (one of the highest of all tracked categories) while for vodka its importance level is low.

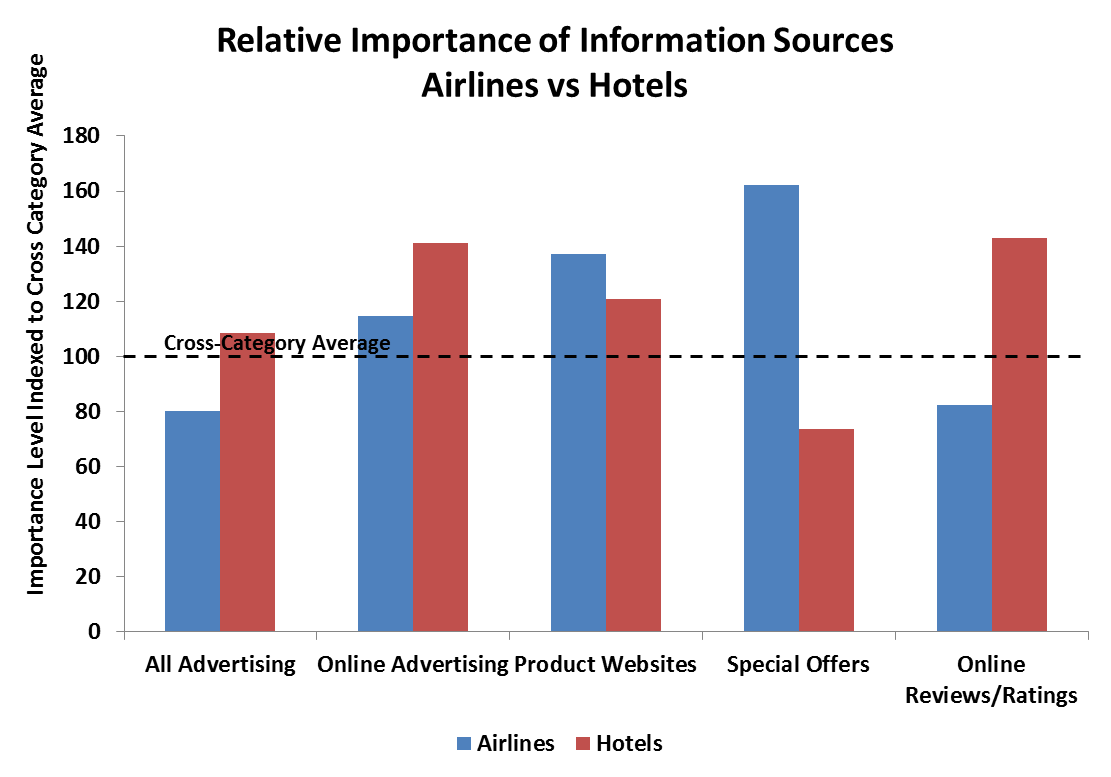

Travel – Offers or Advertising?

The travel industry is booming with the younger generation looking ever more to experiences over possessions. In TBSM we track two travel categories – hotels and airlines. Everyone likes to boast about a great travel deal, but where are deals more important and how is advertising viewed?

While travel booking websites like Expedia and Priceline seem to tie different travel categories together, in fact there are some very large differences in how potential customers view information sources for hotels and airlines. First, advertising is viewed as substantially more important for hotels for all advertising types except for outdoor. Online advertising is viewed as quite important in both travel categories versus the overall category average, but particularly so for hotels. Similarly, product websites are viewed as quite important in both travel categories.

The big differences? Special offers are viewed as extremely important for airlines while online reviews and product ratings are vital for hotels. When it comes to staying the night, avoiding the bedbugs and foul odors is imperative but when it comes to cruising above the clouds it’s price, period!

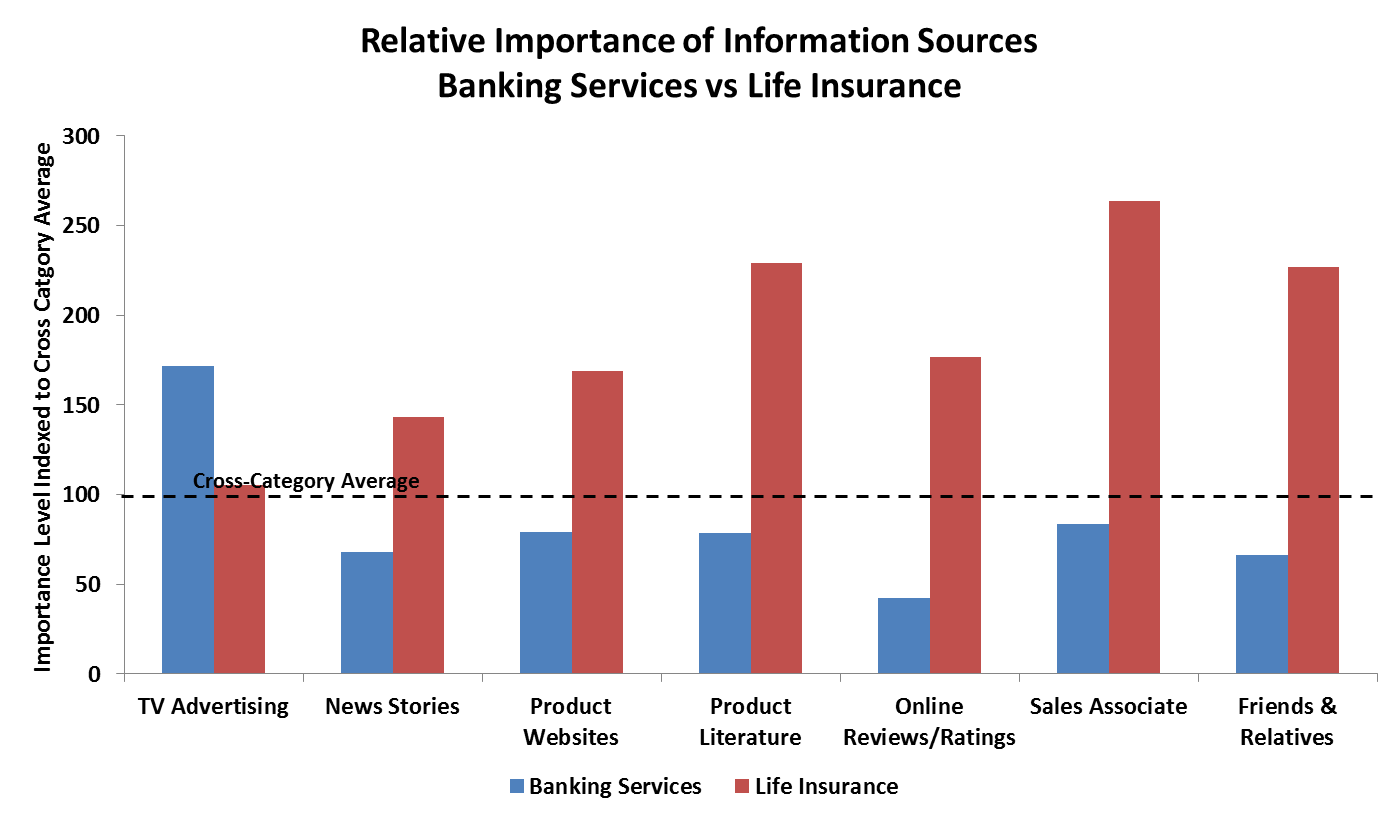

Your Money or Your Life?

It’s an age old question – which is more important, your money or your very existence? In TBSM we track both the banking services and life insurance categories. And when it comes to the importance put on information sources, the results are encouraging for humanity. While television advertising seems to be quite sufficient for those seeking information on banking, those interested in life insurance are willing to seek out a range of important information sources.

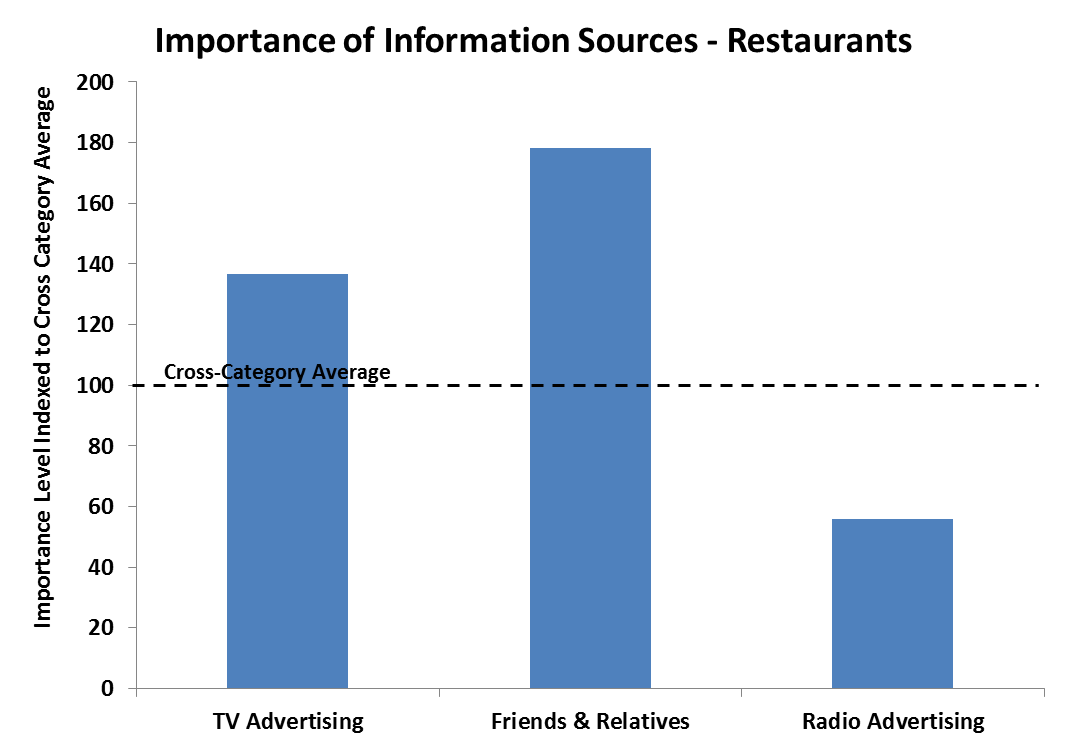

Where to Eat Tonight? Let’s Ask Uncle Television

Finally when it comes to the question of where to eat, we all are looking for someplace new and interesting. When it comes to information sources for restaurants, TBSM reveals there are two that dining customers are much more likely to depend on than customers in other categories. Both TV advertising and word of mouth from friends and relatives index very highly for restaurants versus other categories. What’s low? Interestingly enough, radio. So maybe there is something to those taste tempting visuals after all!

The Brand Strength Monitor can help you understand the dynamics of your particular category. Please contact us at sales@thebrandstrengthmonitor.com for more information.