If you are a sports fan, then chances are you are aware that this is quite an exciting time of the year for College Football. With all the talk of rivalries, advantages, disadvantages, and strategies, it made us here at MSW-ARS think: What if top brands played in bowl games? How would those matchups look?

Using our 2016 Brand Strength Monitor data (TBSM), we did just that, and we will be sharing these throughout the month.

Last week , we took a look at a few matchups that included brands sponsoring bowl games in the next month. This week, we thought we would mix things up and take a look at some big brand rivalries that do not necessarily have any bowl game ties.

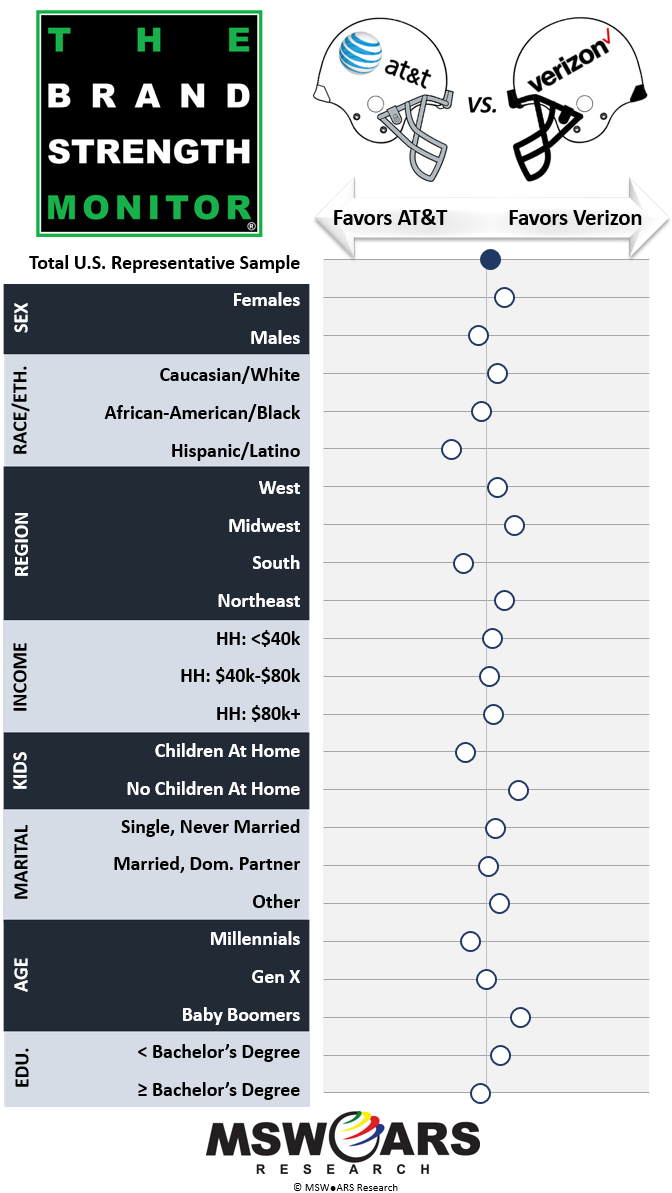

You can’t talk about rival companies for long without mentioning AT&T vs. Verizon. If you followed our election blogs, then you know these two had one of the closest finishes, so why should their bowl matchup be any different?

|

|

In fact, we have this rivalry about as close as you can get – within a percentage point of one another in 2016 with regard to brand preference.

The lead switches many times as you go down the demo groups – including AT&T winning among Males, non-Caucasians (especially Hispanics), and Southerners. They also lead among non-Baby Boomers who have children at home, indicating there may be something enticing regarding their family plans.

Verizon, on the other hand, leads among Females, Baby Boomers, and all non-South regions, which gives them the slight overall advantage. |

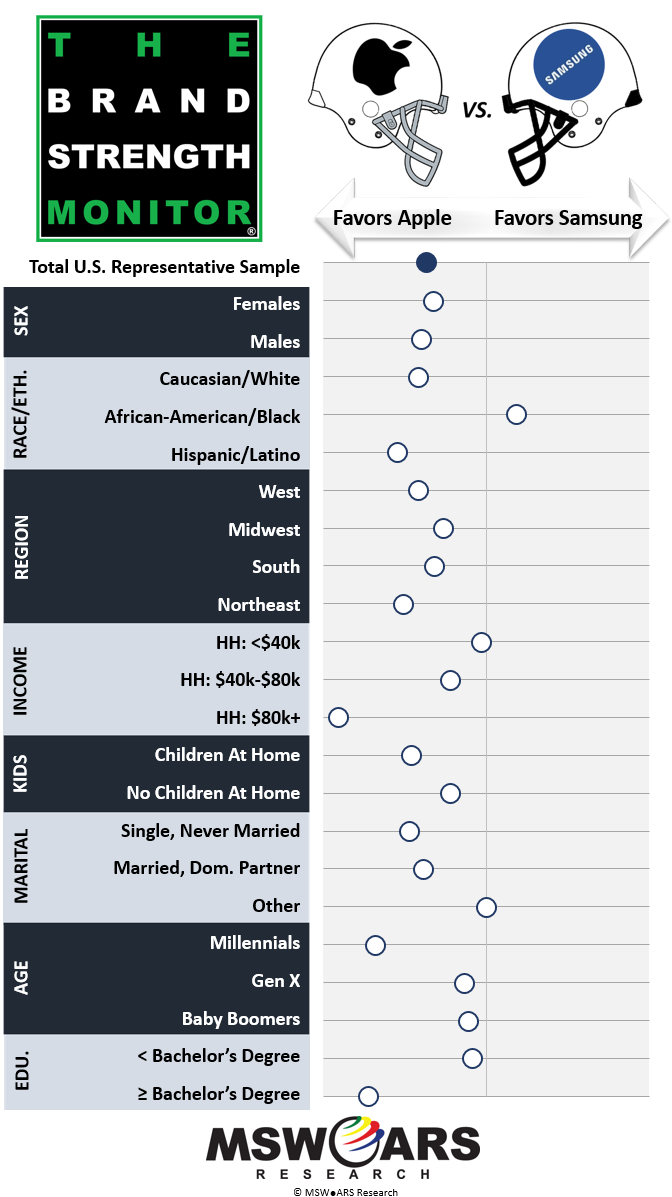

Just like AT&T vs. Verizon, Apple vs. Samsung is also a huge rivalry – especially in the smartphone category. Obviously, if you have paid attention to the news in 2016 (and our blogs regarding Samsung’s brand crisis ), then you know Samsung’s standing looked a lot better a year ago than it does now due to battery fire problems, but since they still have considerable brand strength (solidly second place in the smartphone market) and are undoubtedly looking toward a strong rebound in 2017, their rivalry vs. Apple is worth a visit.

|

|

As we mentioned, the way this category currently stands, this one is not much of a contest as Apple is winning most demographic groups, and would be the clear favorite in a bowl matchup.

However, a closer look also reveals vulnerabilities that a recovering Samsung can look to target. For instance, Apple appears to have a stranglehold on the young, highly educated, higher income group, but other areas are much closer for Samsung. This includes older, lower income/educated consumers – especially in the South and Midwest. Samsung’s lone advantage appears to be among African-American consumers by quite a decent margin.

You will hear a lot about certain traditional power programs being in “rebuilding mode” during this bowl season – Samsung could say the same thing. |

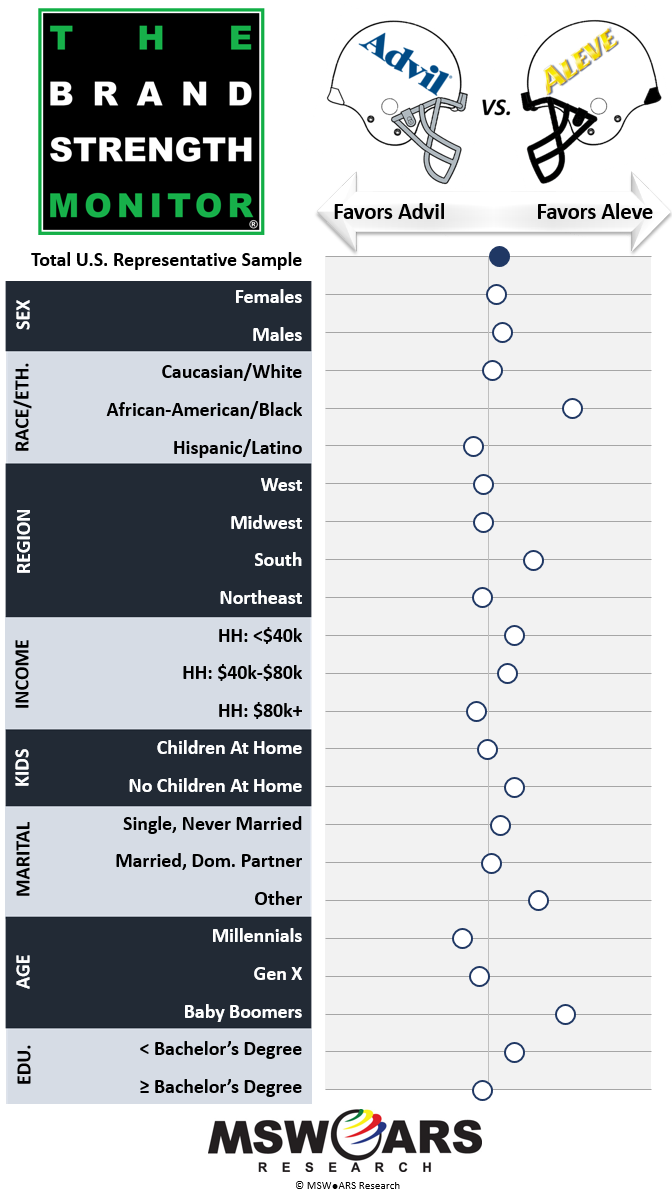

Another well-known rivalry with some interesting data for us to share is Advil vs. Aleve in the Internal Analgesics category. Depending on the physicality of the bowl game, players (and fans and coaches for that matter) may be involved in this category.

| Aleve has a slight brand preference edge over Advil, driven by their success with African-American consumers, Baby Boomers, and Southerners.

Advil actually holds an edge in the majority of regions (West, Midwest, Northeast) as well as age groups (Millennials, Gen X), yet still manages to trail slightly because of Aleve’s strengths in those demos.

|

|

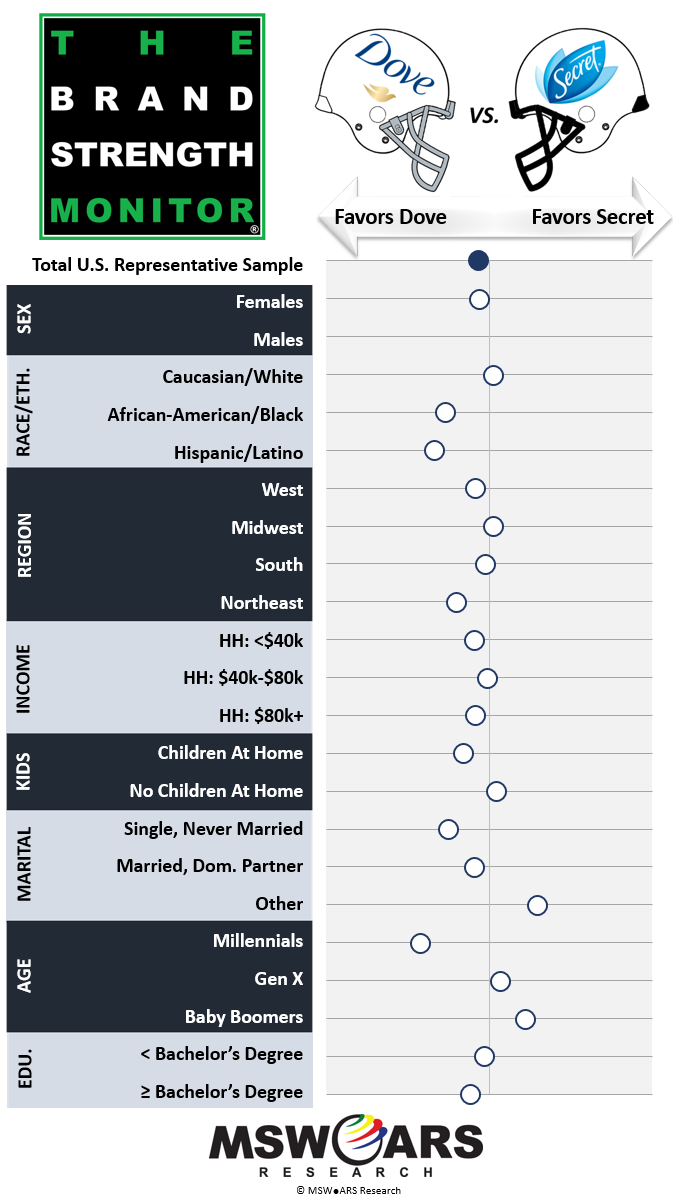

Last, but definitely not least, we are going to throw in a bonus rivalry this week. Like the others, it’s not exactly “college football bowl relevant,” but it is such a close rivalry that it deserves to be discussed. That is, the rivalry between the Women’s Anti-Perspirant/Deodorant brands of Secret and Dove.

| Dove has a slight edge over Secret, driven by strong showings among Millennial, single, non-Caucasian consumers.

As seen with other close matchups, Secret actually leads among the majority of age groups (Baby Boomers, Gen X), though Dove’s strengths with Millennials and elsewhere appear to make up for that.

|

|

That is it for this week, but we will be back with more matchups before the end of the bowl season.

If you would like to know more regarding the data and platform used here, then please contact us at sales@thebrandstrengthmonitor.com

Our TBSM metric is the ONLY Independently Validated Measure of Brand Value.

Thank you very much for reading and we hope you enjoy future weeks’ blogs as well as the actual bowl games!