It is difficult to watch or read the news without hearing about political divisions in the US. Whether

they’re talking Democrats, Republicans, Libertarians, or the Green Party, there seems to be a lot

of disagreement out there. However, we here at MSW●ARS Research have discovered factions you

may not have even known existed until now – with consumer categories. As a fun repurposing of the

data we collect using our Brand Strength Monitor platform, we are getting to the bottom of

this – one category at a time.

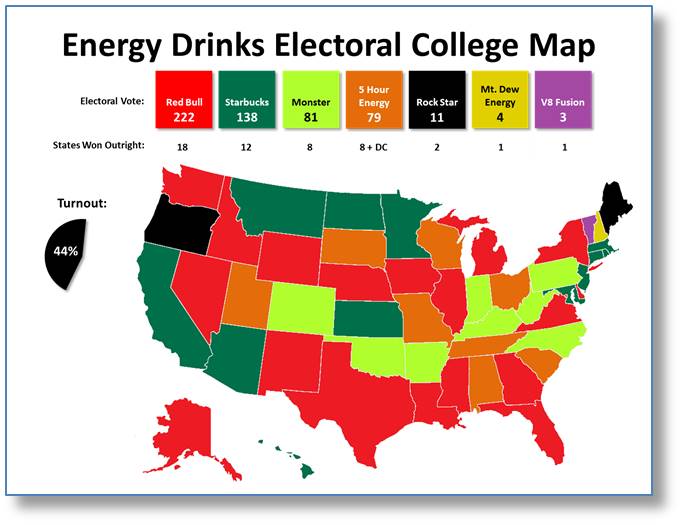

Throughout the 2016 US Presidential Election season we’re sharing some “voting” results. Instead of the

traditional red state/blue state/swing state format, we’re looking at “voting” results for some of

the more than 60 categories on The Brand Strength Monitor Dashboard to determine which brand would

win an election versus its category competitors.

Instead of simply looking at the “popular vote” across thousands of respondents, we decided it would

be a lot of fun to look at results by state Electoral College votes – similar to how the US actually

elects its president every four years.

Thus far, we have shown you three very different election outcomes in Light Beer,

Bottled Water, and Toilet Paper.

However, in each of those cases, there has been at least some degree of regionality.

With Energy Drinks, this week’s category, the map is much more complex as various brands have

strong wins in different regions of the country. Which Energy Drink you prefer actually appears to

be more driven by socioeconomic factors than where you live; however, with four very strong brands

in the category, it’s difficult and likely not very fair to typecast any of the brands with a certain

type of consumer. That said, the socioeconomic makeup of this category is a topic for another day

(one we can gladly dig into, if you’d like). Onto the map:

- As we saw with Bottled Water, no Energy Drink brand is able to reach the 270+ electoral votes needed

to win the presidency, so we will be heading to the House of Representatives with this category

as well!

- Red Bull achieves the highest amount of electoral votes as well as states won outright. Red

Bull’s wins are scattered far and wide, including the large states of Florida, Texas, New York,

and Illinois. It also wins Washington state, which is a bit of a surprise given the brand that

comes in 2nd place in this category is based out of Seattle. Though the vote margin is not that

great in Washington State, the fact that Red Bull can pull out a victory there at all is impressive

and indicative of the brand’s national strength.

- The 2nd place brand we were alluding to before, Starbucks, is also able to achieve wins

across the map – including the largest state of California. Starbucks also lost Florida’s 29

electoral votes by a razor thin margin, which would have put them within 30 electoral votes of

Red Bull (we promise we recounted all ballots, hanging chads or not, and the results did not

change there).

- As an aside, we should point out that Starbucks has a bit of an ace up their sleeve in this category,

so there is definitely a silver lining for them despite this 2nd place finish in the electoral

vote. It is quite possible that years from now this map could look very different. We say

this because Starbucks appears to be best positioned to benefit from category growth that

occurs with Energy Drinks, which is currently less than half of the population (44%). Starbucks

benefits from their cross-category name recognition/equity and actually would be the choice

of a greater number of those who are currently not involved in the category. Among the category

behavior groups we collect, Starbucks sees their brand preference increase significantly

among those not involved:

- Among those having “personally bought” Energy Drinks: 15.9%

- Among those having “used, but not personally bought” Energy Drinks: 18.2%

- Among those having “not bought/used, but intending to buy/use” Energy Drinks: 20.3%

- Among those claiming to be “not interested in [Energy Drinks]”: 30.6%

- We should also mention that Millennials are twice as likely to be involved in this category as

Non-Millennials, so as time goes on there is glaringly obvious potential for growth.

- Getting back to the state-by-state vote, Monster narrowly achieves third place with its own collection

of cross-regional states, including Pennsylvania, North Carolina, Indiana, and Colorado.

- The brand neck-and-neck with Monster is 5 Hour Energy as they are able to win in Ohio, Wisconsin,

Missouri, and Tennessee, among others.

- Though Rock Star does not have the same national footprint as the brands finishing ahead of

them, they are able to win two states that are among those furthest apart geographically: Oregon

and Maine. This is a microcosm of this category’s general lack of concern with regionality, which

makes results like these all the more interesting.

- Mountain Dew’s Energy Drink offerings perform well across the nation, though they are only

able to come in first place in New Hampshire. Like Starbucks, Mountain Dew could also benefit

from category growth as they do better with those not currently in the category, though not quite

at the level of Starbucks.

- V8 Fusion is able to win in Vermont and its three electoral votes. This may be a result of

low base sizes in the state, but a win is a win!

- As previously mentioned, this data is a by-product of what we standardly collect in our TBSM (The

Brand Strength Monitor) platform. It is the ONLY independently validated measure of brand

value – available for a fraction of the cost of almost all brand health studies these

days.

- Each month, we collect 1,000 respondents for each category, which standardly include roughly the following demographic breakouts for brand choice and category penetration:

- Females: 500

- Males: 500

- African-Americans: ~130

- Hispanics: ~100

- Millennials (Age 35 and Under): ~400

- Non-Millennials (Age 36 and Over): ~600

In addition, the following demographics are also standardly available in many different splits:

- Yes/No Children in Household

- If Yes, Age of Children in Household

- Education Level

- Some High School, High School Diploma, Bachelor’s Degree, Master’s Degree, etc.

- Income Level

- Split 15 ways from $7,500 or less to $200,000 or more

- Marital Status

- Single, Married, Domestic Partnership, Divorced, etc.

- States (as we used in our map above)

- All 50 states + DC, as well as custom regions – if desired

The brands included in this Energy Drink exercise are:

- 5-hour energy

- Amp Energy

- Bawls Guarana

- Beaver Buzz

- Bomb

- Burn

- Canna

- Celsius

- Cocaine

- Crunk!!! Energy

- EnerBee

- Full Throttle

- Go Girl

- Guru

- HiBall

- Hype

- Jolt

- Monster

- Mt. Dew Net

- No Fear

- Nos

- Red Bull

- Rock Star

- Rocky Mountain High

- Rooster

- Starbucks

- V8 VFusion

- Your Favorite Other Brand

MSW●ARS is already tracking this data for the following categories. Let us know if you see

one you are interested in, or if you would like us to begin tracking your category:

- Antiperspirants/Deodorants (Women)

- Antiperspirants/Deodorants (Men)

- Analgesics, Internal

- Athletic Shoes (Women)

- Athletic Shoes (Men)

- Auto Insurance

- Bank Services

- Bar Soap

- Bathroom Tissue

- Bleach or Laundry Whiteners

- Blue Jeans (Women)

- Blue Jeans (Men)

- Body Lotions (Women)

- Body Lotions (Men)

- Bottled Water

- Breakfast Bars

- Cable or Satellite TV Subscriptions

- Caramel/Toffee Snacks

- Casual Dining Restaurants

- Cell Phone Carriers

- Chewing Gum

- Chocolate Candy

- Cloud Data Storage

- Coffee Machines

- Credit Cards

- Energy Drinks

- Fabric Softeners

- Facial Moisturizers for Women

- Facial Tissue

- Fitness Trackers

- Frozen Entrees

- Hair Coloring (Women)

- Hair Coloring (Men)

- Hair Dryers

- Home/Renters Insurance

- Hotels

- Ice Cream

- Kitchen Cleaners

- Laptop Computers

- Laundry Detergent

- Life Insurance

- Light Beer

- Liquid Hand Soap

- Mayonnaise

- Microwave Ovens

- Microwave Popcorn

- Mouthwash

- Online Movies/TV/Video Streaming Services

- Orange Juice

- Packaged Coffee

- Personal Computers

- Products from a Big Box Retailer

- Quick Serve Restaurants

- Salty Snacks

- Sedans

- Smart Watches

- Smartphones

- Streaming Media Players

- Tablet Computers

- Tea

- Televisions

- Trucks

- Yogurt

If you see some data you would like to see expanded upon, please send us a note at sales@thebrandstrengthmonitor.com.

Thank you for reading and we will continue to release maps for new categories as the 2016

US Presidential Election approaches.