Brand managers can change pricing and distribution, but that doesn’t always translate into a change in market share. That is because there is a variable in the equation that can make or break forecasts put in place using pricing and distribution figures alone. That variable is brand preference.

We here at MSW●ARS have a brand preference measure that is unlike any other because it is the ONLY independently validated measure of brand preference available.

Though we’ve been collecting our brand preference measure for decades, a recent breakthrough occurred in January 2016 when we launched The Brand Strength Monitor (TBSM), which made the measure widely available in a syndicated system. It allows brands to receive a monthly update on their brand health that can easily be split by key demographics for a very reasonable price due to the syndication.

In this blog series we’ll be sharing insights from this data, and focusing on the biggest winners and losers from Q1 2016 to Q1 2017, including causes as well as implications for their respective categories.

We have already shared two winners during this time period in Amazon Fire Stick and Adidas. This week, we are going to begin to share brands with preference levels that have been trending in the wrong direction.

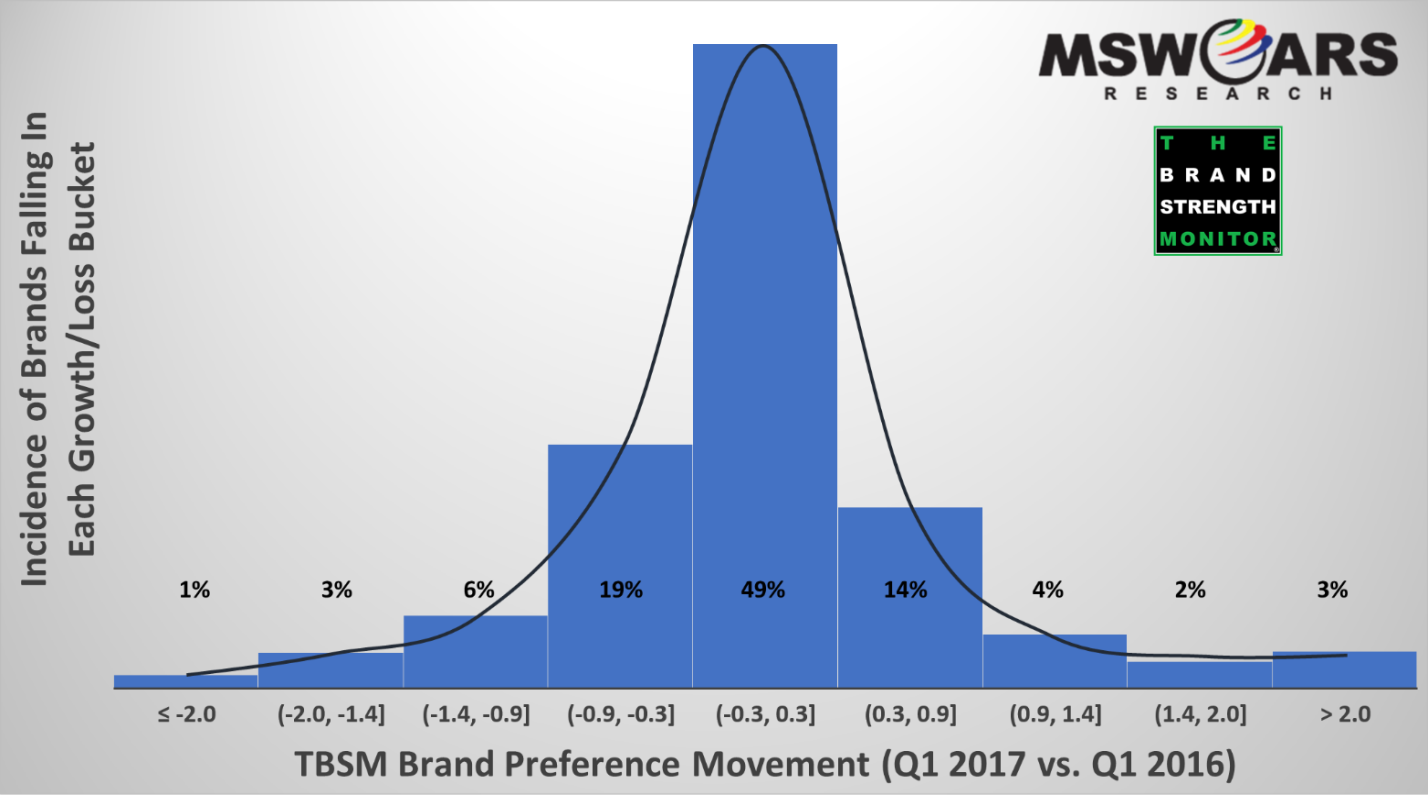

Before we reveal the brand, we would like to remind you just how difficult it is for a brand to move our brand preference needle (like actual market share itself). It does not overreact by showing changes that are not happening in market. In fact, as the following bell curve shows, about half of the 750+ brands tracked during Q1 2016 and Q1 2017 see essentially no change (±0.3). Over 80% of the brands we track see a change of a point or less.

So, that is why the +6.1 change achieved by Amazon Fire Digital Media Players as well as the changes north of +3.0 for Adidas Women’s and Men’s Athletic Shoes were so impressive, and why the brand for this week is also very noteworthy – but for the opposite reason.

That brand is Subway, which is tracked in the Quick Serve Restaurants (QSR) category. They have the unfortunate distinction as being part of the 1% of tracked brands that saw a loss of more than two points in preference from Q1 2016 to Q1 2017.

If you have followed Subway in the news over the past couple years, then it probably does not seem out of the realm of possibility that the company may be encountering some challenging times with their brand image. Just last month it was reported by FOX News and multiple media outlets that the number of Subway restaurants was shrinking for first time in company history.

The article goes on to cite changing tastes in the US as well as negative publicity (scandals) in recent years as potential reasons for the decline.

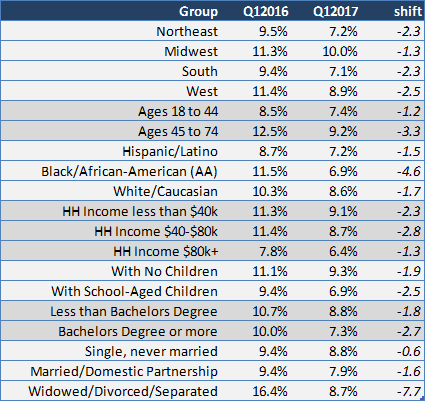

With our TBSM data, we are able to easily dissect which demographics are driving this decrease in brand preference in the table below:

When you are suffering losses at Subway’s current rate, it is very difficult to find any silver linings in any demographics – the overwhelming majority of them are going to be negative.

The most eye-opening statistics in this table are likely that Subway is seeing the sharpest declines among African-American consumers as well as consumers ages 45 to 74 (especially those no longer married).

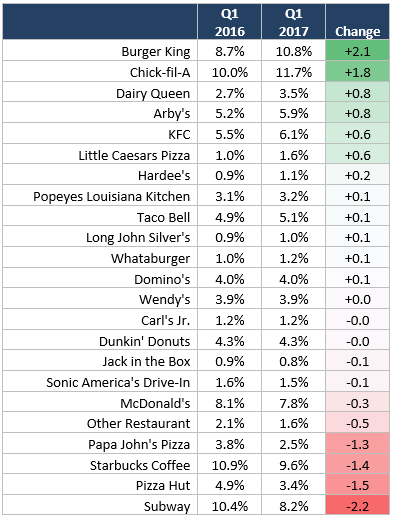

Using TBSM, we can also take a look at which brands in this category are seeing increases where Subway is seeing losses.

Among those seeing preference increases are Burger King and Chick-fil-A, indicating that the offerings from these restaurants, which may have little in common with Subway in terms of types of food offerings, are becoming more appealing.

According to a Q1 2017 article from GSP Retail (https://www.gspretail.com/burger-kings-successful-pop-strategy/ ), Burger King’s recent marketing strategy has been one that effectively leverages their stated mission, “To offer reasonably priced quality food, served quickly in attractive, clean surroundings.” In fact, we covered Burger King’s success over the past year, along with its acquisition of Popeyes, in a recent blog post.

According to mid-2016 piece by CNBC (http://www.cnbc.com/2016/06/15/how-chick-fil-a-went-from-cult-favorite-to-fast-food-behemoth.html ), Chick-fil-A can thank their growth to an effective menu, great customer service, and positive diner experience.

Subway’s preference losses are likely benefitting restaurants that do not necessarily serve similar food, including two with the fastest growing preference, who are making their new name more with experiences and effective advertising than copying Subway’s past strategy.

If you would like more information regarding this or other data, then feel free to send us a line at sales@thebrandstrengthmonitor.com.

Thank you for reading and we look forward to sharing more learnings in the future.